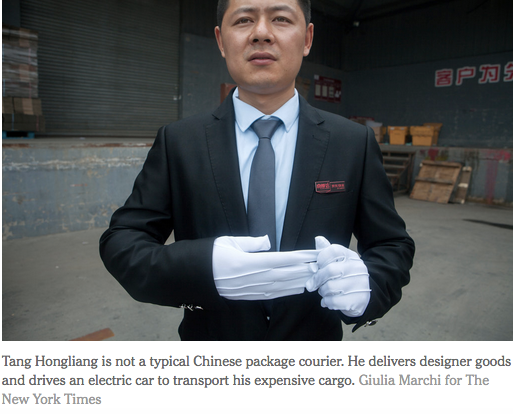

Decked out in a black suit, dark gray tie and white gloves, Mr. Tang does not look like a typical Chinese package courier. Instead of piping hot noodle lunches, he delivers a $2,400 designer handbag. Rather than a three-wheeler, he drives an electric car to transport expensive cargo. In the time he makes one or two deliveries, the typical Chinese courier would have made about 150.

“Efficiency is of course important,” said Mr. Tang, who works for the online retailer JD.com. “But serving the customer is the most important.”

Facing slowing sales, global luxury brands are angling for a piece of China’s e-commerce market, where people are accustomed to buying gadgets and groceries, but not high-priced jewelry and haute couture. Many are unsure, however, about diving headfirst into online retail, because China’s favorite way to shop is also an industry better known for piracy and dusty deliverymen than for shine and polish.

To court the luxury market, companies like Alibaba and JD.com are using their vast customer base to offer upscale retailers support on issues like digital marketing, pricing, customer services and, in the case of Mr. Tang, delivery.

“The most difficult thing to overcome is the experience for the shoppers,” said Xia Ding, president of JD.com’s fashion division. “But because we own the logistics we are really able to deliver luxury goods in a way that makes shoppers feel like they are getting the same special experience as they get offline.”