“The Trump budget proposal makes clear his desire to enact massive cuts to health care, anti-poverty programs, and investments in economic growth to blunt the deficit-exploding impact of his tax cuts for millionaires and corporations,” said Rep. John Yarmuth (D-Ky.), the top Democrat on the House Budget Committee. “These cuts to critical federal investments are so extreme they can only reflect a disdain for working families and a total lack of vision for a stronger society.”

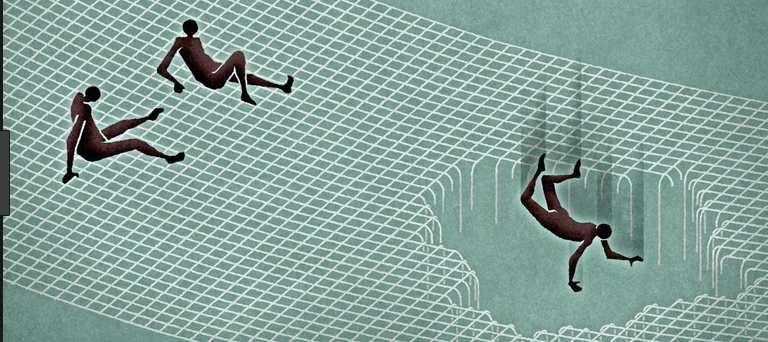

The biggest factor in the White House’s deficit problems appears to be issues caused by the tax law, which the Trump administration had previously refused to acknowledge would occur.

The White House had promised that last year’s tax cut plan would pay for itself by generating so much revenue that it would not add to the deficit. This ran in sharp contrast to numerous forecasts that found that it would add $1 trillion to $2 trillion to the debt over 10 years.

Monday’s budget proposal paints a much different picture of the tax plan’s eventual effect compared to what the Treasury Department and the White House had projected. It forecasts that tax revenue will plummet in the next few years and never recover to the levels forecast before the tax plan was enacted in December.