You can try to play down a trade war with China. You can brush off the impact of rising oil prices on corporate earnings.

But if you’re in the business of making economic predictions, it has become very difficult to disregard an important signal from the bond market.

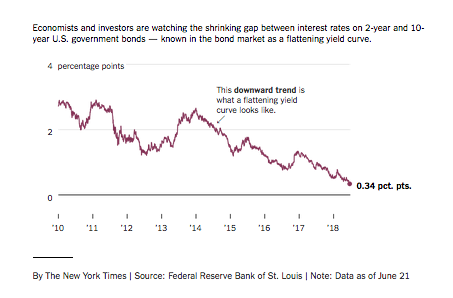

The so-called yield curve is perilously close to predicting a recession — something it has done before with surprising accuracy — and it’s become a big topic on Wall Street.

Terms like “yield curve” can be mind-numbing if you’re not a bond trader, but the mechanics, practical impact and psychology of it are fairly straightforward. Here’s what the fuss is all about.

First, the mechanics.

The yield curve is basically the difference between interest rates on short-term United States government bonds, say, two-year Treasury notes, and long-term government bonds, like 10-year Treasury notes.

Typically, when an economy seems in good health, the rate on the longer-term bonds will be higher than short-term ones. The extra interest is to compensate, in part, for the risk that strong economic growth could set off a broad rise in prices, known as inflation. Lately, though, long-term bond yields have been stubbornly slow to rise — which suggests traders are concerned about long-term growth — even as the economy shows plenty of vitality.

At the same time, the Federal Reserve has been raising short-term rates, so the yield curve has been “flattening.” In other words, the gap between short-term interest rates and long-term rates is shrinking.