Economists tell us that there is no such thing as a free lunch — that you must always give up something of value to get something you value more.

But Americans may be getting something close to a free lunch in the $2 trillion economic rescue package, thanks to an accommodating Federal Reserve and a financial slight-of-hand known as “monetizing the debt.”

. . .

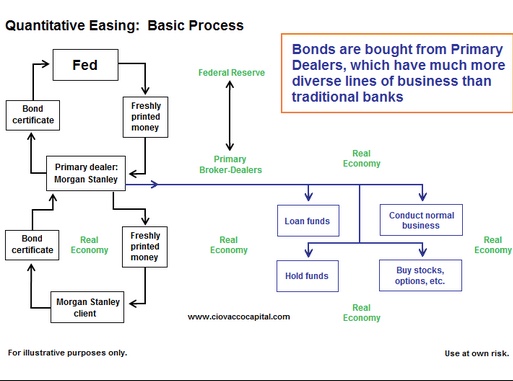

And where will the Fed get these trillions of dollars? That’s easy. All it has to do is print as much money as it needs by increasing the balance that banks have “on reserve” at the Fed. That power to print money is engraved at the top of every bill in your wallet, in the words “Federal Reserve Note.”

In other words, one arm of the government will create $2 trillion out of thin air and then lend it to another government agency, which will turn around and give or lend it to households, businesses, hospitals and local governments.

The Fed rejects the idea that it is engaged in anything so sketchy as monetizing the national debt. It sees itself as merely fulfilling its mandate to promote full employment and price stability. And in good times and bad, the way the Fed accomplishes this mission is by buying and selling Treasury notes in the open market.