The $1.5 trillion tax overhaul that President Trump signed into law late last year has already given the American economy a jolt, at least temporarily. It has fattened the paychecks of most American workers, padded the profits of large corporations and sped economic growth.

Those results weren’t a surprise. Economists across the ideological spectrum predicted the new law would fuel consumer spending, in classic fashion: When the government borrows money and dumps it into the economy, growth tends to accelerate. But Republicans did not sell the law as a sugar-high stimulus. They sold it as a refashioning of the incentives in the American economy — one that would unleash more investment, better efficiency and higher wages, along with enough growth to offset any revenue lost to the government from lower tax rates.

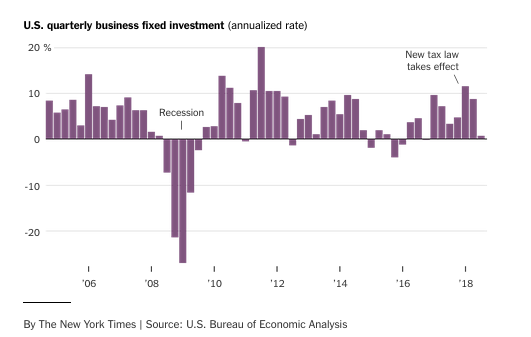

Ten months after the law took effect, that promised “supply-side” bump is harder to find than the sugar-high stimulus. It’s still early, but here’s what the numbers tell us so far: