I have been a critic of Obamacare since it became law, but the Republican alternative is worse in nearly every way.

The American Health Care Act, which was narrowly passed in the House last week, would worsen Obamacare’s problems rather than fix them. Coverage would be disrupted for millions almost immediately, according to a Congressional Budget Office analysis of a previous iteration of the legislation.

The bill would end Obamacare’s individual mandate, already too weak as a policy mechanism, and impose a fee on those who go without coverage and want to re-enter the insurance market — creating an incentive for relatively healthy people to remain uncovered. As a result, the instability that already exists in Obamacare’s exchanges as insurers scale back around the country would only be increased.

It’s unclear what health policy problem this bill would solve. Even for an opponent of Obamacare, it is difficult to understand why House Republicans chose this path to revamping the nation’s health care system.

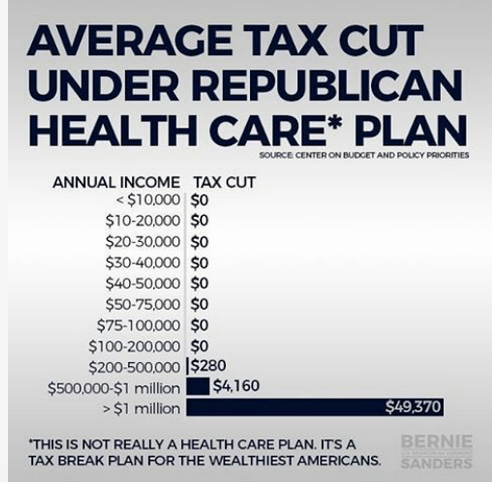

It’s difficult to understand, that is, if you think they were passing a health care bill. It makes more sense when you realize that isn’t what they were doing at all. They were passing a tax cut — one intended to pave the way for more tax cuts.

. . .

Republicans have consistently had difficulty making the case for the bill on health policy merits. It’s not even clear that most House Republican lawmakers know what’s in the legislation. “I don’t think any individual has read the whole bill,” Representative Tom Garrett of Virginia said. Why then did House Republicans push so hard to pass this health care bill?

Because it cuts taxes — especially for the top 20 percent of earners — and so sets up the broader tax reform legislation Republicans hope to pass later in the year.

To understand how this might work, it helps to understand a little bit about Senate procedure.

The Senate effectively requires 60 votes to pass most legislation, but Republicans hold only 52 seats. However, Senate rules allow for the passage of certain types of legislation using a process known as reconciliation, which requires only a simple majority. Republicans planned to use the reconciliation process to go it alone on both health care and tax reform.

But that process comes with conditions. There’s a ticking clock; the reconciliation instructions that allow for the passage of the health care bill expire as soon as the next budget resolution is introduced. And the process does not allow for the passage of legislation that raises the deficit outside the 10-year budget window via a simple majority.

This, for example, is why the tax cuts passed under President George W. Bush in 2001 were set to expire after a decade. For tax cuts to be permanent, they must be deemed “revenue neutral.”

That is where the American Health Care Act comes in: It would eliminate roughly $1 trillion in taxes used to pay for the additional spending in Obamacare. As a result, it would significantly lower the federal government’s tax revenue baseline. The baseline is an important figure in congressional budgeting, because it sets expectations for how much the government is projected, on paper, to spend and raise if current law remains the same.