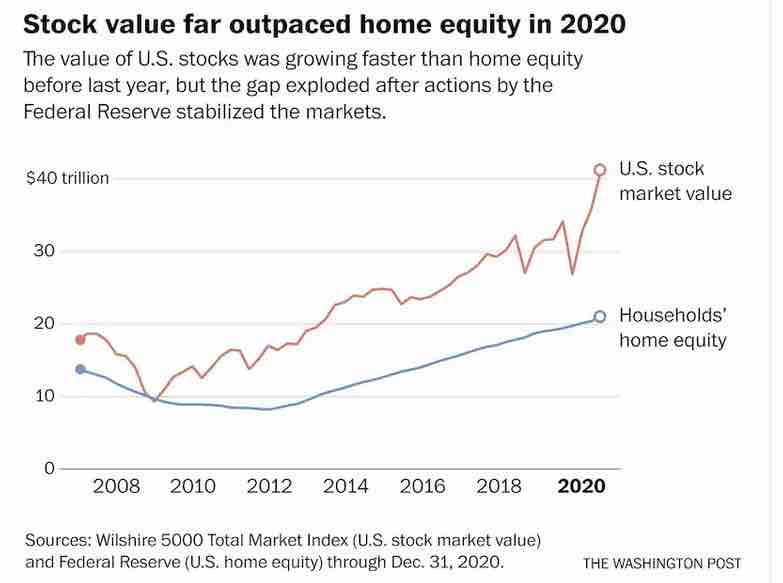

Ever since the covid-19 pandemic struck, the Federal Reserve has gotten plenty of kudos for moves that have helped stabilize the economy, kept house prices from tanking and supported the stock market. But those successes have obscured another effect: the inadvertent impact the Fed’s ultralow interest rates and bond-buying sprees are having on economic inequality.

Long-standing inequality in the United States has been exacerbated by the Fed’s role intouching off a multitrillion-dollar boom in stock markets — and stock ownership is heavily skewed toward the wealthiest Americans.

In contrast, soaring stock prices don’t help people like Wina Tan. Tan, 59, is one of the millions of Americans nearing retirement age whose greatest source of wealth isn’t stocks or equity in a home. Rather, it’s the Social Security checks she expects to start getting once she retires.