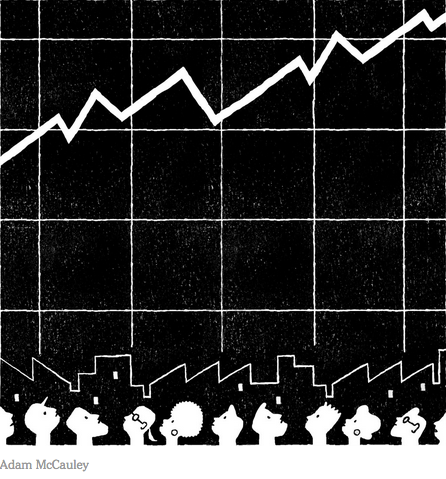

Foster City, Calif. — The tax cut framework recently put forward by President Trump relies on a central claim: that reducing taxes on corporations and wealthy individuals will open the wellsprings of entrepreneurship and investment, turbocharging job growth and the American economy. Were this premise true, reasonable people might countenance giving a vast majority of benefits to the very rich, as Mr. Trump’s plan does, in exchange for greater prosperity for all. But it’s not.

I am what certain politicians call a “job creator.” Two recessions ago, in 2001, five partners and I founded a software company in Silicon Valley. After great difficulty and great good fortune, that company grew to serve customers in over 30 countries, generating over $500 million in annual revenue and employing more than 2,000 professionals in high-skilled, high-paying jobs — a large majority of them in the United States. Today I am the chief executive of that company, Guidewire Software, valued on the New York Stock Exchange at over $5 billion.

As an entrepreneur myself and a friend to many others, I know that lower tax rates will not motivate more people to start companies. People start companies for many reasons: a compelling idea, ambition for fame and fortune, a desire to be one’s own boss, frustration with one’s employer. I have never heard someone say, “I would have started a company, but tax rates were too high” or “I wouldn’t have started this company, but then George W. Bush cut tax rates, so I did.”