Recent announcements by Apple, Walmart, AT&T, Starbucks and other businesses that they are giving workers raises, repatriating foreign profits and investing in the United States because of the tax bill Congress passed last year are clearly music to the ears of President Trump and Republican lawmakers. But these statements are also cleverly designed public relations spin that tells us little about the actual long-term economic impact of the tax law.

Let’s put some context around these corporate proclamations. The economy is humming, with the unemployment rate at 4.1 percent. This is, of course, very good news. But beware the spin: Regardless of what’s in the tax overhaul, businesses have an incentive to raise wages to retain and attract workers because of the tight job market. It is also very much in the political interest of companies to attribute to the new tax law the changes they make to salaries or investment plans. That’s a surefire way to win favor with Mr. Trump, a notorious sucker for flattery. And it is a way to deflect attention from the insidious aspects of the tax law: It will add about $1.5 trillion to the federal deficit over 10 years, and many poor and middle-class families will pay more taxes over time.

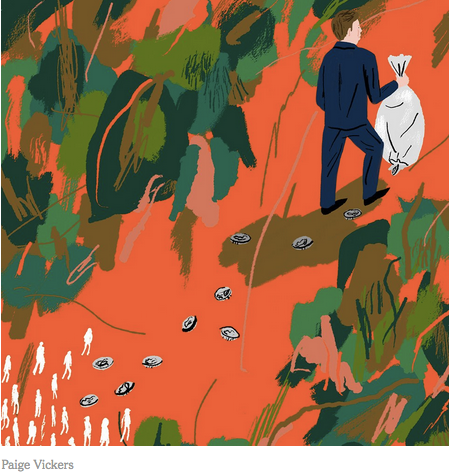

It’s the corporate elite who stand to benefit most from the tax law. Lloyd Blankfein, the Goldman Sachs chief executive who supported Hillary Clinton in the 2016 election, told CNBC recently that he “really liked” what the president is doing for the economy.