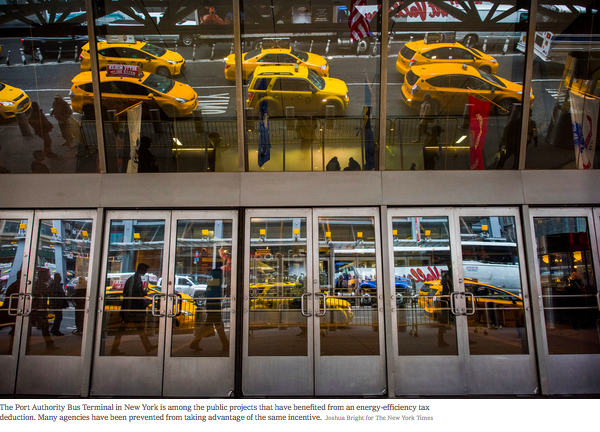

Over the past decade, hundreds of public projects have benefited from a federal incentive meant to encourage investments in energy-efficient technology. The Port Authority of New York and New Jersey used it to save $1 million on building One World Trade Center and upgrading bus terminals and airports. In Florida, Miami-Dade County sliced $1.13 million off the price tag of an improved cooling system in its county hall, courthouses and downtown sports arena.

But a growing chorus of public agencies complain that they were prevented from benefiting from this same incentive in their own building projects. Conflicting interpretations of the law and how it should be applied, they say, have caused taxpayer-funded schools, prisons, military bases and libraries throughout the nation to lose out on millions of dollars in savings.

The issue has heated up as state and local governments, and other public entities, move more aggressively to claim a piece of this federal subsidy. Lobbyists and lawyers have joined the scramble as Congress revisits this incentive and decides whether to extend it along with a raft of other tax breaks left out of last year’s tax overhaul.

The Joint Committee on Taxation has estimated that this one energy deduction, over the past five years, was worth $1.1 billion. Yet even as public entities miss out on the savings, a juicy chunk of the money is going to consulting firms that handle the complex certification and filing requirements.