The biggest effect of the Trump tax cuts is obvious: People who own businesses and other sources of concentrated wealth will have a lot more money, and the federal budget will have less. But the advocates of the tax cuts insisted it wasn’t about letting the makers keep their hard-earned money rather than handing it over to the takers. It was about incentivizing business to repatriate funds and ramp up its investments, thereby increasing growth and wages.

The Congressional Research Service, a kind of in-house think tank for Congress, has a new paper analyzing the effects of the Trump tax cuts. It finds that none of those secondary effects have materialized. Growth has not increased above the pre-tax-cut trend. Neither have wages. After a brief and much smaller than expected bump, repatriated corporate cash from abroad has leveled off.

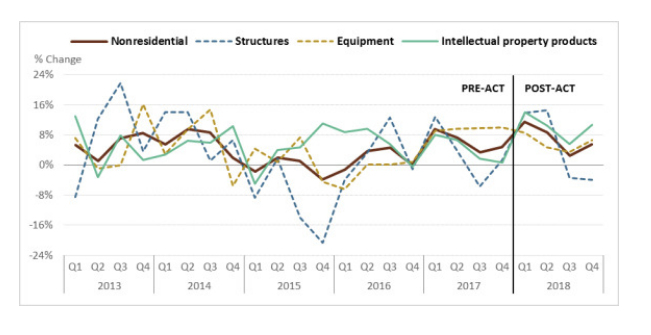

It’s of course possible that the growth in wages would take longer than the year or so that has passed since the tax cut to show up. If the Trump tax cut had encouraged new business investment, it might take years for the new investment to bear fruit. But the study looks directly at business investment and finds … nothing:

. . .

“CBO, in its first baseline update post enactment, initially estimated that the Act would reduce individual income taxes by $65 billion, corporate income taxes by $94 billion, and other taxes by $3 billion, for a total reduction of $163 billion in FY2018. Corporate revenues were about $40 billion less than projected whereas individual revenues were higher, with an overall revenue reduction of about $9 billion. From 2017 to 2018, the estimated average corporate tax rate fell from 23.4% to 12.1% and individual income taxes as a percentage of personal income fell slightly from 9.6% to 9.2%”.