“There are thousands of moving pieces in full-blown tax reform,” said Jeffrey Birnbaum, an author of a book about the passage of that legislation, “Showdown at Gucci Gulch,” and now a public affairs strategist at BGR Group. “Every entity and interest you can think of has a stake, and there are inevitably winners and losers. And if you’re a loser, you know it.”

Add in a more polarized political environment, an administration that has been light on policy expertise, and a Republican congressional contingent that hasn’t shown much ability to pass complex legislation in more than a decade, and the puzzle looks all the more complicated.

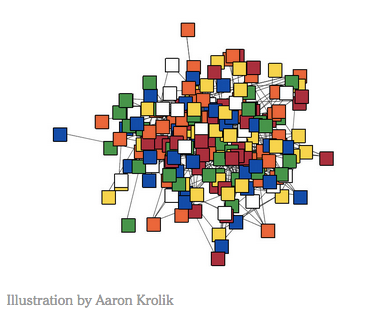

Congress and the Trump administration will solve tax reform only by navigating difficult trade-offs. Think of these trade-offs as the six sides of a Rubik’s cube, each of which needs to match up perfectly — but each of which can foul up the others.