Like or loathe Donald J. Trump, you have to give him this: He’s done more to shine a spotlight on the loopholes and fundamental unfairness of the tax code than any other American president.

In doing so, he’s made a powerful case for tax reform, though perhaps not quite along the lines he has in mind.

Details aside, the bottom line is that by 2005, the Trumps appear to have significantly reduced their taxes by offsetting $813 million of income thanks to the loss carry-forward. Many millions more would have gone untaxed, thanks to other loopholes that wouldn’t show up on just two pages of Form 1040.

Hope Hicks, a White House spokeswoman, declined to comment for this column.

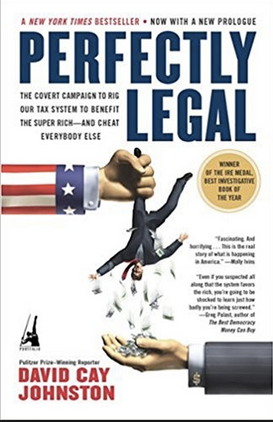

There is nothing inherently illegal, of course, about using the tax code to minimize what one owes. But all of this should make perfectly clear, if it wasn’t already, why presidents need to release their tax returns.

Will Mr. Trump’s proposals for tax reform address these loopholes? Or will they simply be efforts to further line his own pockets and those of family members who now run the Trump Organization?

“We’ll never know unless he releases his returns,” Mr. Rosenthal said.