BERKELEY, Calif. — An incoming sophomore at the University of California Riverside, Samantha Yazzie frets about the $20,000 she had to borrow — not for tuition, but for housing during her freshman year alone.

“I worry about paying it back,” Yazzie said.

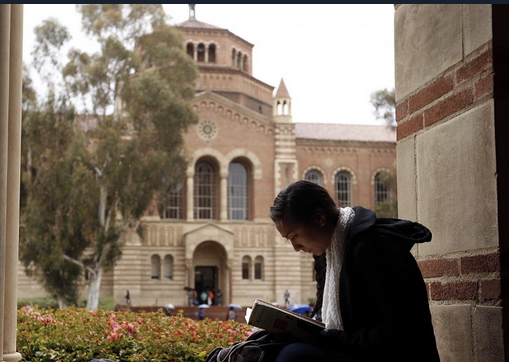

In the seven years since prices started rising dramatically at California’s public universities, this state has swum against the tide by trying to ensure — more than most others — that its poorest residents can still afford to go to college.

It provides a comparatively large amount of financial aid, while its University of California system campuses offer discounts to lower-income students using, in part, money that comes in from their higher-paying out-of-state and international classmates.

But California’s attempts to keep college affordable mask the reality that the poorest students still struggle more than ever to cover its costs. Even here, rising prices have led three-quarters of the lowest-income UC students to take out loans, often for costs other than tuition — a significantly higher proportion than other income groups. A UC education now eats up nearly two-thirds of the discretionary income of families making $30,000 per year or less, according to the Institute for College Access and Success.

“Clearly something is going awry,” said Debbie Cochrane, the institute’s research director.