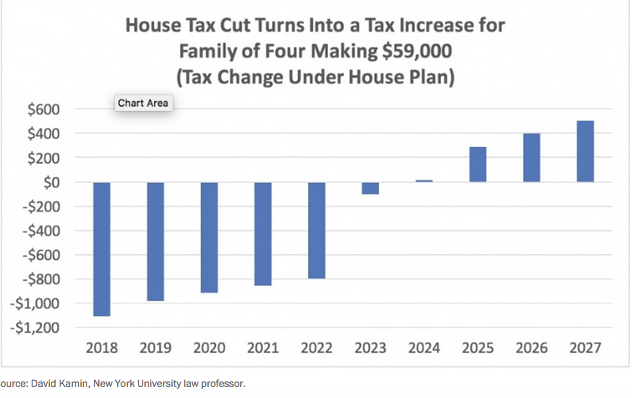

House Speaker Paul D. Ryan spoke often Thursday (and tweeted) about how a typical family of four that makes $59,000 a year would get a $1,182 tax cut, but that’s only in the first year. There are already serious doubts about how much the middle class benefits from the GOP plan — and for how long.

Ryan’s correct that $59,000 is smack dab in the middle of the income spectrum. It’s the median income in the United States, meaning half of households make more in a year and half make less. He’s also right that this family would pay $1,182 less than they paid in 2017. But that model family would get a tax hike by 2024, according to an analysis by David Kamin, a tax law professor at New York University.

It’s “totally absurd,” Kamin says. “The tax cuts for the middle class are all front loaded.”

One of the key provisions in the GOP tax bill to help middle class families is a new Family Flexibility Credit of $300 for each tax filer and another $300 for a spouse. But that credit expires after five years, making the math for the middle class A lot less rosy. In 2023, the year the tax credit would go away, the $59,000 family would barely get any tax reduction at all, and by 2024, there would be an increase, Kamin found.