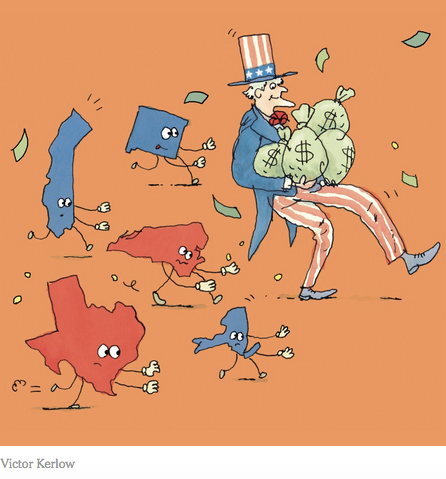

Do congressional Republicans and President Trump want to undertake a multitrillion-dollar federal bailout of states and cities? If not, the Senate and House should squelch their competing proposals to reduce or eliminate Americans’ ability to deduct state and local taxes on their federal tax forms.

Curtailing tax breaks is generally a good idea. Subsidies for certain activities distort the economy. When the mortgage-interest deduction spurs a family to buy a more expensive home than they would have otherwise, it keeps that money from more productive parts of the economy.

But state and local tax deductions do not fall into this category. Since the nation’s founding, American citizens have safeguarded small-scale democracy. The Bill of Rights prescribes that “the powers not delegated to the United States by the Constitution, nor prohibited by it to the states, are reserved to the states.”

Scholars and judges differ over where state control ends and federal oversight starts. But no scholar argues that states, cities and towns don’t possess the right and obligation to staff schools, pave roads, purify water and put out fires.

For this, local and state governments need money — which they mostly get from their own taxpayers, not from Washington. To assert that the federal government has the primary claim on this tax dollar, as Republicans are doing, is to claim that the federal government bears the primary responsibility for these tasks.