The Federal Reserve on Wednesday suggested it would not raise interest rates in 2019, a dramatic about-face that indicated the central bank’s worries about the economy are intensifying.

“Growth is slowing somewhat more than expected,” Fed Chair Jerome H. Powell said at a news conference. “While the U.S. economy showed little evidence of a slowdown through the end of 2018, the limited data we have so far this year have been somewhat more mixed.”

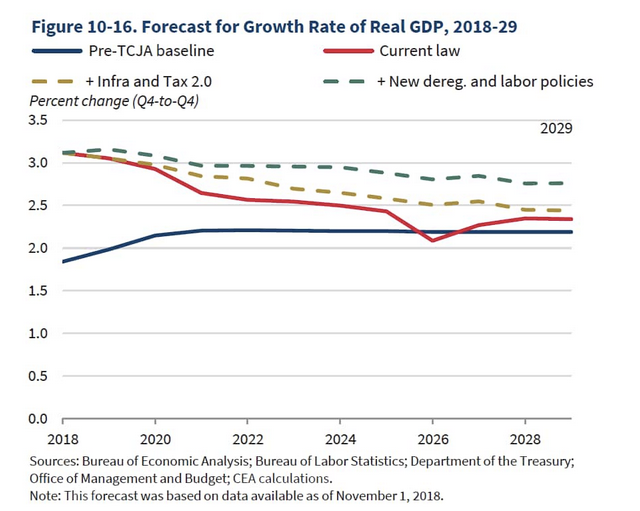

The Fed entered the year expecting growth of 2.3 percent and that two rate hikes would be necessary to keep the economy from overheating, but on Wednesday it cut its growth forecast to 2.1 percent for 2019 and signaled it was done hiking rates for the year.

The Fed pulled back from its plan to raise interest rates as Europe and China deteriorated economically and U.S. consumers and businesses showed worrying signs of lower spending. Those concerns have been amplified as companies such as FedEx predict a mediocre year and trucking volumes have declined.