Wall Street analysts have grown increasingly pessimistic in recent weeks about the outlook for corporate profits, even as investors have pushed markets steadily higher, breaking the link between analyst forecasts and the direction of stock prices.

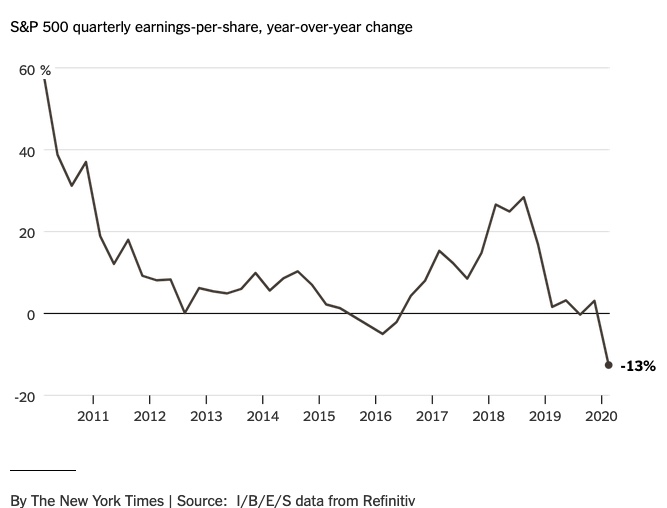

Most companies in the S&P 500 stock index have reported their first-quarter earnings, and the impact of the coronavirus pandemic on profits is becoming clear, at least for January through March. On a per-share basis, profits of S&P 500 companies fell by 13 percent, making it the worst slump since 2009.

. . . .

The most powerful reason is simpler: It’s the actions of the Federal Reserve.

Since March 23 — the day the stock market rally began — the Fed has done its best to ensure that the returns on bonds are quite low by signaling its willingness to buy unlimited quantities of Treasury and government-backed mortgage bonds. It has also ventured into buying corporate bonds, which helped push yields on such bonds lower too. The goal, in part, is to push investors away from the safety of the bond markets and into riskier assets, like stocks.

In a recent note, analysts at JPMorgan argued that these programs by the Fed “likely has a bigger positive impact on equity valuation, compared with the negative impact of the temporary earnings loss.”