After watching stocks march higher for nearly nine years, investors are suddenly confronting a new reality: The long, smooth ride is over. And it doesn’t feel good.

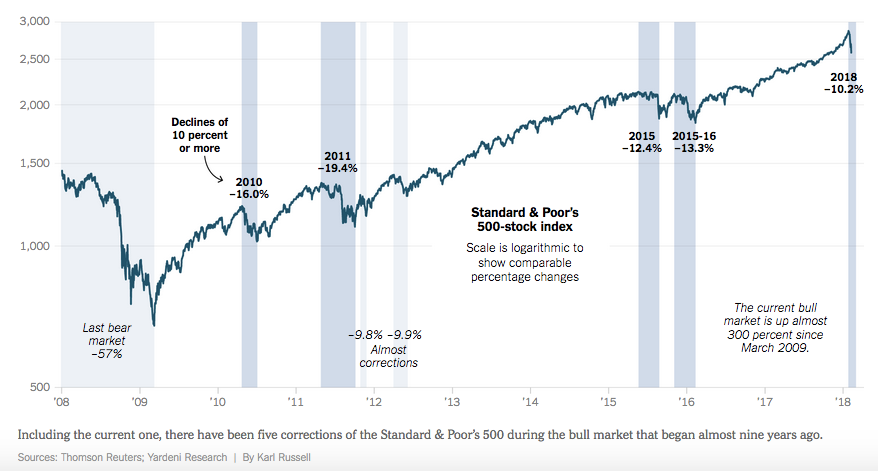

Major stock indexes suffered a steep drop in late trading on Thursday, the second-straight day that stocks dived shortly before the markets closed. The 3.75 percent decline pushed the Standard & Poor’s 500-stock index down more than 10 percent from its peak in late January. That means the market is technically in correction territory — a term used to indicate that a downward trend is more severe than simply a few days of bearish trading.

“We’ve been trained that the market does nothing but go up,” Bruce McCain, chief investment strategist at Key Private Bank, said of investors. “And then suddenly, they’re anxious, they’re sitting nervously on the sidelines, and then they can’t take it anymore.”

Trying to pinpoint the exact reasons for the last week’s tumble is a fool’s errand. But the most likely culprit appears to be fear that central banks will increase interest rates in an effort to fend off inflation and ensure that fast-growing economies don’t overheat. Those fears were stoked Thursday when the Bank of England warned that it might raise interest rates faster than investors had expected.