“You all just got a lot richer,” Trump reportedly told guests at Mar-a-Lago. But Republicans will nonetheless keep insisting that the corporate tax cut that is the main item in the tax bill is really for the benefit of workers. They will be aided in this claim by some recent corporate announcements of bonuses or wage hikes that they attribute to the tax cut.

It’s nonsense, of course. Think of the motivation: lots of companies are raising wages at least a bit in the face of tight labor markets; pretending that it’s because of the tax cut is a cheap way to curry favor with an administration that has no hesitation about using regulatory and antitrust decisions to reward friends and punish enemies. It’s basically Carrier all over: make a Trump-friendly splash by declaring that he persuaded you to save jobs, then lay off lots of workers after the cameras have moved on.

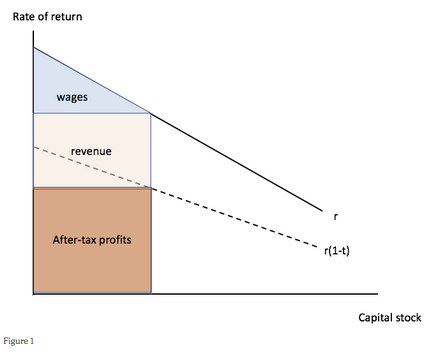

But there’s a larger point here: even if you believe economic analyses that suggest corporate tax cuts are good for wages, it shouldn’t happen right away. Any trickle-down should come about because the tax cuts lead to higher investment, which leads over time to a larger capital stock – and it’s the increase in the capital stock, which may take many years, that leads to the wage rise.