Republicans are paying for a permanent cut for corporations with an under-the-radar tax increase on individuals.

Senate rules require the Tax Cuts and Jobs Act not to add to the federal deficit after 10 years. Failing to meet that window would result in legislative defenestration, as it would require 60 votes in a Senate that has only 52 Republicans.

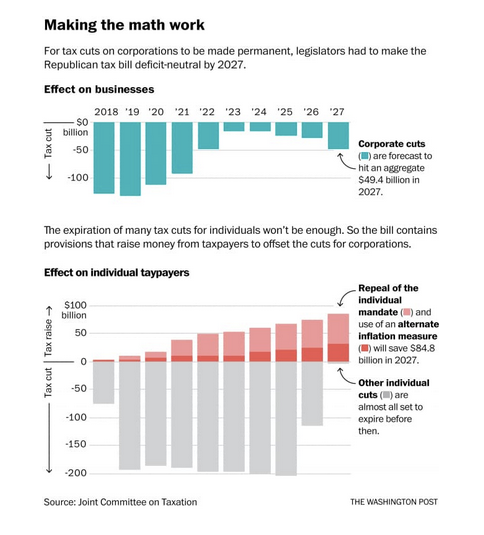

The bill aims to cut corporate taxes in perpetuity, under the theory that to do anything less would be to create uncertainty for corporations. But to do so and still have the bill not be a money loser after a decade, they need to raise extra funds somewhere.

That’s why Republicans can’t just let the individual tax cuts expire, as they do at the end of 2025, but they actually need to raise money to offset the permanent corporate tax reduction.

This chart, playing off what the Senate’s former top tax aide and New York University professor Lily Batchelder pointed out on Twitter on Friday evening, makes vividly clear where Republicans ultimately raise that money: