The one-page document issued by the White House offered only a few details. For middle-income families, there were three key elements:

- Reducing the seven tax brackets to three tax brackets for 10 percent, 25 percent and 35 percent

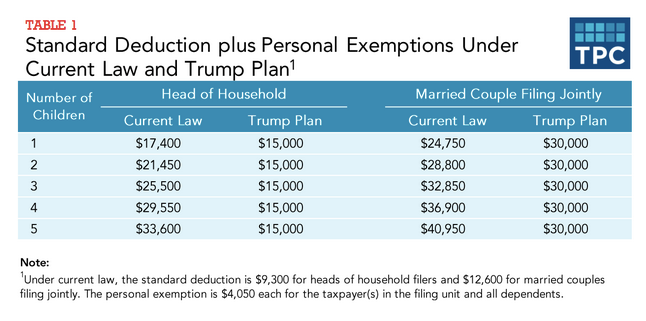

- Doubling the standard deduction

- Providing tax relief for families with child- and dependent-care expenses

The document claimed that targeted tax breaks that benefit mainly the wealthy would be eliminated. But the plan would also repeal the alternative minimum tax, the estate tax and a 3.8 percent tax on investment income that was part of the Affordable Care Act. Removing the AMT, designed to ensure that the wealthy pay at least some tax, especially might save some taxpayers a lot of money; Trump’s 2005 tax return that was recently revealed showed that he paid an additional $31 million because of the AMT.

. . .

A chart from Batchelder’s report shows that even with an increase in the standard deduction, the elimination of personal and dependent exemptions would leave many with higher taxable incomes.

Here are some specific examples from her report:

- A single parent with $75,000 in earnings and 2 school-age children would face a tax increase of about $2,440.

- A single parent with $50,000 in earnings and 3 school-age children would face a tax increase of about $1,188.

The existing standard deduction that Americans can claim is $6,300 for individuals and $12,600 for married couples filing jointly. During the campaign, Trump proposed raising the standard deduction to $15,000 for individuals and $30,000 for families. So the official proposal has a smaller increase, meaning that even more working-class families could see a tax increase.