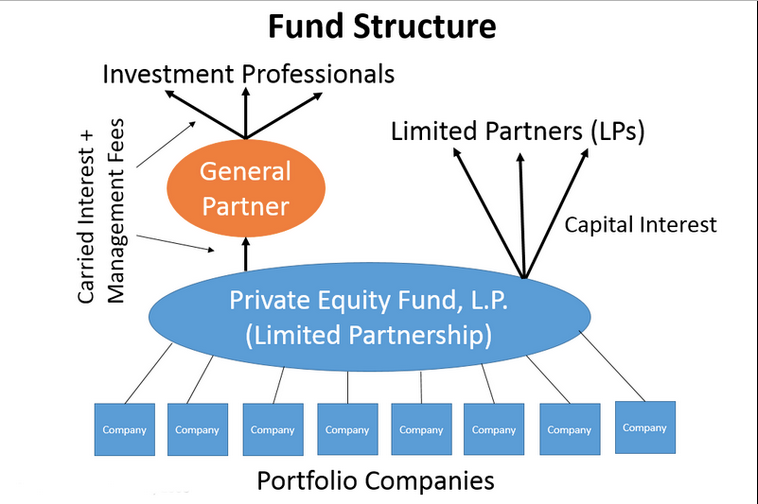

Carried interest, which is essentially the profits reaped by hedge fund managers and private equity executives, is currently taxed at a long-term capital gains rate that is about half the roughly 40 percent ordinary income rate for the highest earners. Critics argue that these executives should pay the full rate, while industry groups say they are entitled to the lower rate because they are taking entrepreneurial risks.

The Trump administration proposal, which was thin in details, does not address the issue of how carried interest should be taxed. Nor has the administration said what, if any, impact its proposal would have on carried interest.

But in interviews, several tax experts and Wall Street lawyers said that by not mentioning the matter at all, the administration seemed to be signaling that the tax proposal would effectively eliminate the unique taxation of carried interest.

That does not mean carried interest would be taxed at a higher rate than it is today. Instead, experts say, the tax rate for carried interest may well go down.

That reading is based on the proposal subjecting pass-through entities — which include partnerships like private equity firms and hedge funds — to a 15 percent tax rate, which is lower than the rate on capital gains and much lower than the top rate on ordinary income.

In other words, it appears that if the Trump plan is enacted, private equity executives would not just avoid higher taxation; their taxes would actually decline.

Carried interest from Wikipedia