Trump’s plan arguably reflects his unique style of conservative populism. The proposal would be extremely costly for the government, and the president’s past comments suggest he would be willing to put the federal government deeper into debt to fund breaks for the middle class.

Ryan’s plan would instead simplify and streamline the tax code in accordance with conservative orthodoxy, eliminating the goodies for households with modest incomes that Trump would preserve or expand.

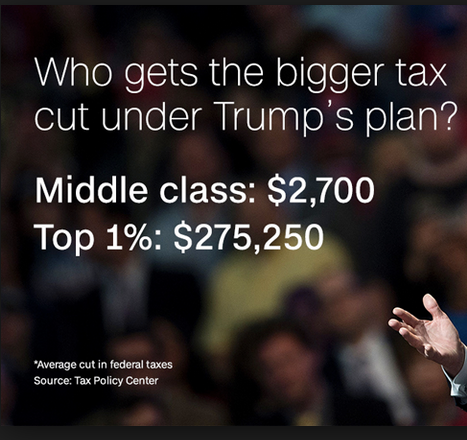

In all, taxpayers with roughly average incomes could expect a tax cut of around $1,100 a year under Trump’s plan, compared to just $60 under Ryan’s plan once the proposals were fully implemented.

After a decade, 99.6 percent of the tax relief Ryan proposed would have accrued to the wealthiest 1 percent of the country. In Trump’s plan, 50.8 percent of the relief would have gone to that group, according to analyses by the nonpartisan Tax Policy Center.