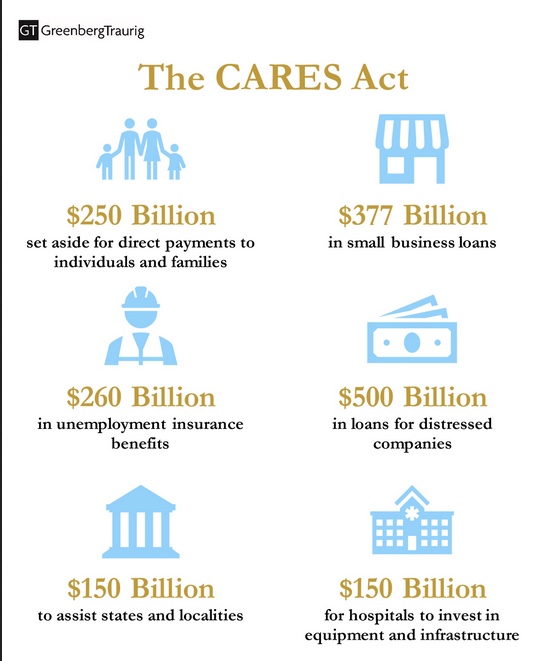

A $500 billion Treasury Department fund created by the Cares Act in March to help stabilize the economy has lent barely any money, according to an initial report issued by a new Congressional Oversight Commission.

The money was supposed to be used to help prop up large segments of the U.S. economy at a time when millions of Americans had lost their jobs or were ordered to work remotely. The Treasury Department has speedily implemented other parts of the Cares Act, but its work on the $500 billion fund has so far led to little action at a time when a growing number of firms are seeking bankruptcy protection and continuing to lay off employees.

Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome H. Powell are expected to be asked about the law’s economic impact on Tuesday when they testify before the Senate Banking Committee.