To understand why the world economy is in grave peril because of the spread of coronavirus, it helps to grasp one idea that is at once blindingly obvious and sneakily profound.

One person’s spending is another person’s income. That, in a single sentence, is what the $87 trillion global economy is.

That relationship, between spending and income, consumption and production, is at the core of how a capitalist economy works. It is the basis of a perpetual motion machine. We buy the things we want and need, and in exchange give money to the people who produced those things, who in turn use that money to buy the things they want and need, and so on, forever.

What is so deeply worrying about the potential economic ripple effects of the virus is that it requires this perpetual motion machine to come to a near-complete stop across large chunks of the economy, for an indeterminate period of time.

No modern economy has experienced anything quite like this. We simply don’t know how the economic machine will respond to the damage that is starting to occur, nor how hard or easy it will be to turn it back on again.

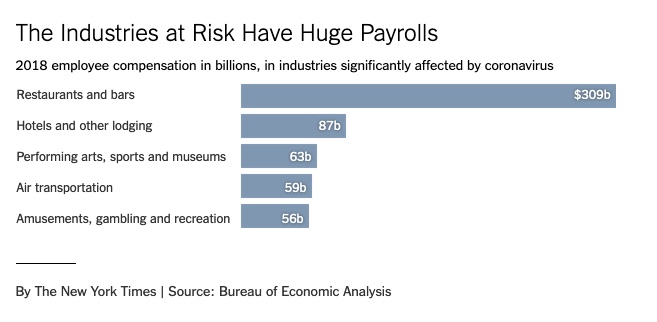

Thanks to government statistical tables, we can understand the sheer size of the economic sectors that appear to be entering a near shutdown. The United States and much of the world are on the verge of a tremendous shrinkage in consumption spending, which in turn will mean less economic output and lower incomes among the people who provide those services.