. . .

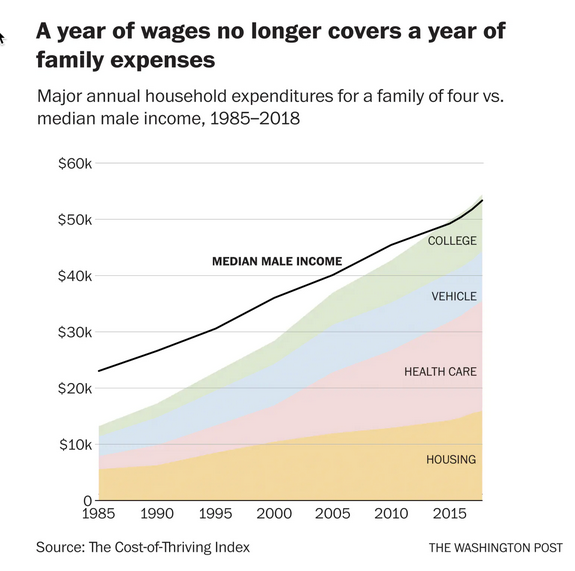

Lead author Oren Cass distills it as follows: “In 1985, the typical male worker could cover a family of four’s major expenditures (housing, health care, transportation, education) on 30 weeks of salary,” he wrote on Twitter last week. “By 2018 it took 53 weeks. Which is a problem, there being 52 weeks in a year.”

. . .

In 1985, the typical male breadwinner could cover those costs and still have 22 weeks of pay left for everything else a family wants and needs, such as food, clothing, entertainment and savings. Today, the typical salary doesn’t even cover the four basics.

It’s worth noting that Cass constructed his index around male earnings because men historically were more likely to be sole breadwinners. Plus, polls show that Americans still view men as the primary provider within a family, even though that’s increasingly no longer the case

Cass also ran the numbers for female earners, whose median wage is about 80 percent that of men. In 1985, the typical woman needed to work 45 weeks to cover the four big annual expenses; today she needs 66 weeks. That means it was easier for a female breadwinner to provide for her family in 1985 than it is for a lone male earner today.