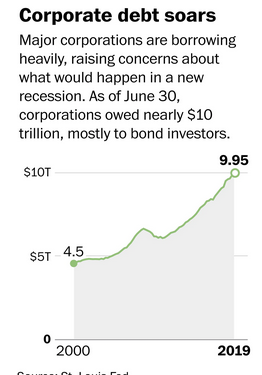

In recent weeks, the Federal Reserve, the International Monetary Fund and major institutional investors such as BlackRock and American Funds all have sounded the alarm about the mounting corporate obligations.

The danger isn’t immediate. But some regulators and investors say the borrowing has gone on too long and could send financial markets plunging when the next recession hits, dealing the real economy a blow at a time when it already would be wobbling.

Some of America’s best-known companies, including AT&T, General Motors and CVS Health, have splurged on borrowed cash. This year, the weakest firms have accounted for most of the growth and are increasingly using debt for “financial risk-taking,” such as investor payouts and Wall Street dealmaking, rather than new plants and equipment, according to the IMF.