MOSCOW — Russia has become a world-class saver. So much gold has piled up in its central bank that Russia surpassed China last year to become the world’s fifth-largest holder of gold.

The International Monetary Fund often has to badger developing nations to bulk up foreign currency reserves. Russia has $472 billion in reserves, more than the country’s combined public and foreign debt of $453 billion and nearly three times what the I.M.F. recommends.

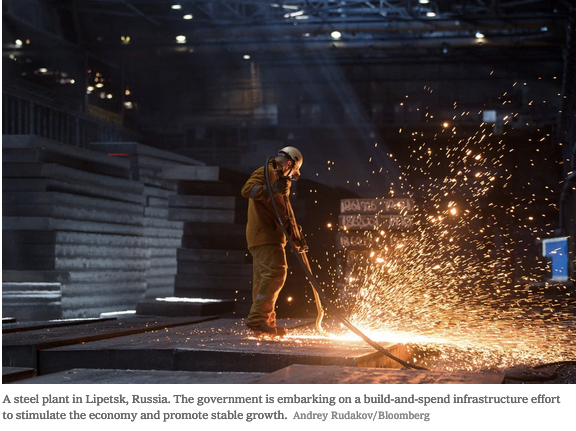

Economists don’t consider either of these eye-popping sums of savings a good thing. They reflect, in part, how investment has lagged in Russia and how Western sanctions have dulled its economy. But the lode is also making for an odd back-to-the-future moment of state-directed economic activity as Russia shifts policy and aims to spend about $100 billion on big infrastructure projects.

The new drive, promoted last month at an economic forum paradoxically named for Yegor T. Gaidar, a former prime minister who championed privatization, is a full-throttle build-and-spend effort to rev Russia’s way to stable growth. Oligarchs are among the businessmen who have been publicly ordered to rally, with moneyed enthusiasm, behind the plan.