The 2017 tax cut has received pretty bad press, and rightly so. Its proponents made big promises about soaring investment and wages, and also assured everyone that it would pay for itself; none of that has happened.

Yet coverage actually hasn’t been negative enough. The story you mostly read runs something like this: The tax cut has caused corporations to bring some money home, but they’ve used it for stock buybacks rather than to raise wages, and the boost to growth has been modest. That doesn’t sound great, but it’s still better than the reality: No money has, in fact, been brought home, and the tax cut has probably reduced national income. Indeed, at least 90 percent of Americans will end up poorer thanks to that cut.

Let me explain each point in turn.

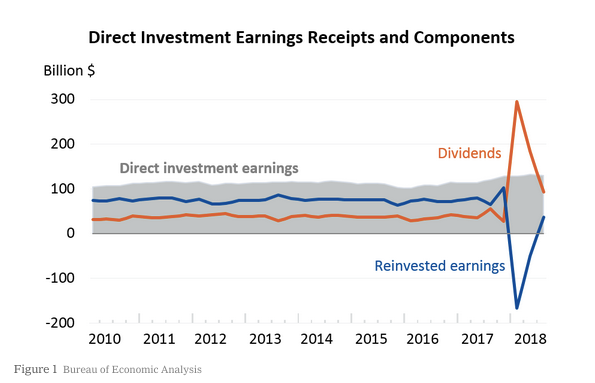

First, when people say that U.S. corporations have “brought money home” they’re referring to dividends overseas subsidiaries have paid to their parent corporations. These did indeed surge briefly in 2018, as the tax law made it advantageous to transfer some assets from the books of those subsidiaries to the home companies; these transactions also showed up as a reduction in the measured stake of the parents in the subsidiaries, i.e., as negative direct investment (Figure 1).

. . .

And it certainly made most Americans poorer. While 2/3 of the corporate tax cut may have gone to U.S. residents, 84 percent of stocks are held by the wealthiest 10 percent of the population. Everyone else will see hardly any benefit.

Meanwhile, since the tax cut isn’t paying for itself, it will eventually have to be paid for some other way – either by raising other taxes, or by cutting spending on programs people value. The cost of these hikes or cuts will be much less concentrated on the top 10 percent than the benefit of the original tax cut. So it’s a near-certainty that the vast majority of Americans will be worse off thanks to Trump’s only major legislative success.

As I said, even the mainly negative reporting doesn’t convey how bad a deal this whole thing is turning out to be.

Read full article