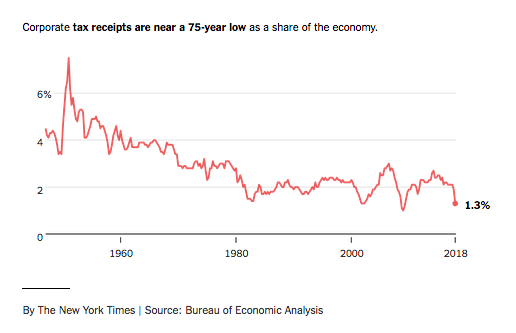

The amount of corporate taxes collected by the federal government has plunged to historically low levels in the first six months of the year, pushing up the federal budget deficit much faster than economists had predicted.

The reason is President Trump’s tax cuts. The law introduced a standard corporate rate of 21 percent, down from a high of 35 percent, and allowed companies to immediately deduct many new investments. As companies operate with lower taxes and a greater ability to reduce what they owe, the federal government is receiving far less than it would have before the overhaul.