Unemployment is sinking and businesses are churning out more goods and services. Yet even with the economy standing on tippy toes, prices and wages are climbing a lot more slowly than anyone has expected.

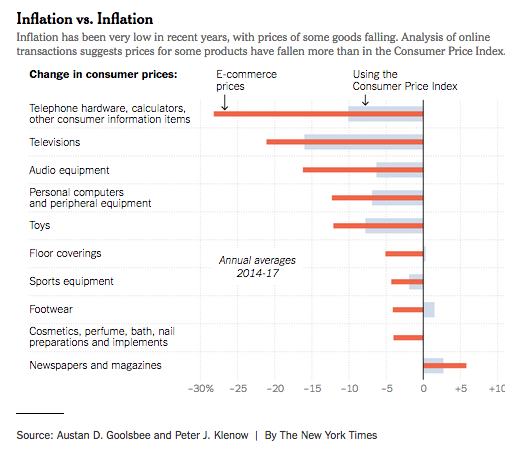

Now a growing body of research is putting the blame more pointedly on e-commerce. The spectacular growth in online shopping, it turns out, is not only tamping down inflation more than previously thought, but also distorting the way it is measured.

The studies reinforce the views of Federal Reserve officials who see the internet’s increasing influence as a leading suspect in a continuing mystery: why inflation routinely falls short of their 2 percent target, considered the sweet spot for keeping the economy humming without overheating.

The caution is unlikely to prevent the Fed from raising benchmark interest rates at its meeting on Tuesday and Wednesday in Washington. Central bankers are engaged in a methodical effort to return rates to levels that prevailed before they were pushed near zero to fuel growth during and after the Great Recession. Some officials have raised concerns that the Fed may need to speed up that process, to prevent inflation from accelerating rapidly as the economy heats up even more.

But some of the latest findings suggest that those fears could be unfounded — and that the official statistics are overstating inflation.