Last year featured a devastating public health crisis, an imploding job market, a heavy dose of political tumult and — surprisingly — a roaring stock market.

Add it all up, and a major consequence was an expansion of inequality in a nation where economic disparity was already on the rise.

It boils down to which groups were hurt most by the sinking parts of the economy and which ones benefited most from the rising share prices.

In the brick-and-mortar part of the economy, lower-wage workers were disproportionately affected by the job losses. At the same time, Americans benefited from gains in share prices: both people who own individual stocks in brokerage accounts and those who own stocks in personal retirement accounts, like mutual fund IRAs, or in those offered by employers, such as 401(k)s.

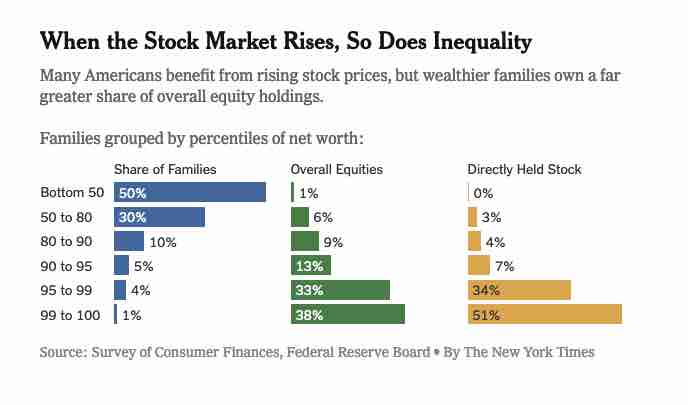

Yet that’s where even more disparity kicked in, an analysis of data from the Federal Reserve’s 2019 Survey of Consumer Finances shows. Although the distribution of income is unequal in the United States, ownership of financial assets in general and stocks in particular is even more so.