Almost a decade ago, Warren Buffett made a claim that would become famous. He said that he paid a lower tax rate than his secretary, thanks to the many loopholes and deductions that benefit the wealthy.

His claim sparked a debate about the fairness of the tax system. In the end, the expert consensus was that, whatever Buffett’s specific situation, most wealthy Americans did not actually pay a lower tax rate than the middle class. “Is it the norm?” the fact-checking outfit Politifact asked. “No.”

Time for an update: It’s the norm now.

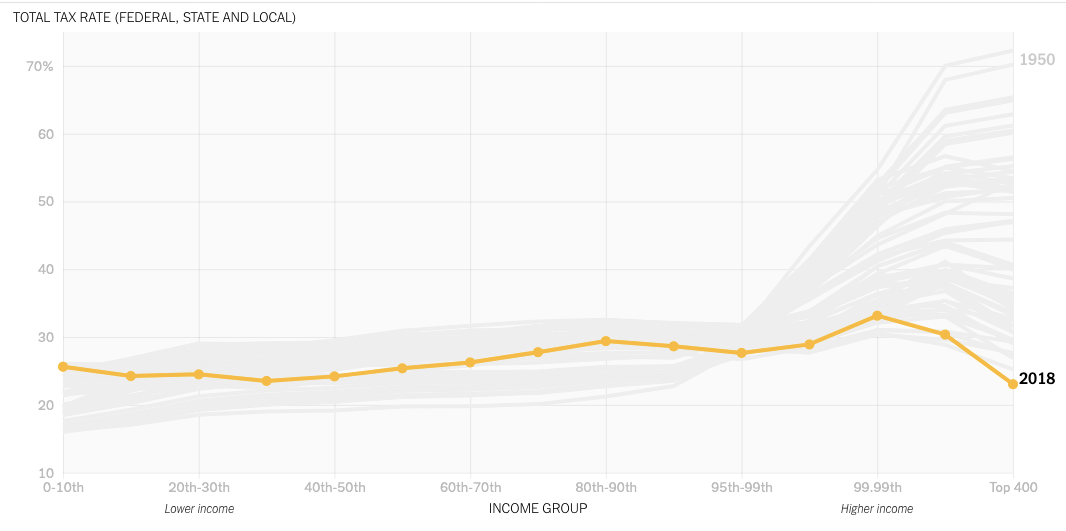

For the first time on record, the 400 wealthiest Americans last year paid a lower total tax rate — spanning federal, state and local taxes — than any other income group, according to newly released data.

The overall tax rate on the richest 400 households last year was only 23 percent, meaning that their combined tax payments equaled less than one quarter of their total income. This overall rate was 70 percent in 1950 and 47 percent in 1980.

For middle-class and poor families, the picture is different. Federal income taxes have also declined modestly for these families, but they haven’t benefited much if at all from the decline in the corporate tax or estate tax. And they now pay more in payroll taxes (which finance Medicare and Social Security) than in the past. Over all, their taxes have remained fairly flat.

The combined result is that over the last 75 years the United States tax system has become radically less progressive.