The global financial crisis is fading into history. But the roots of the next one might already be taking hold.

Financial crises strike rich countries every 28 years on average. Often, the break between busts is much shorter.

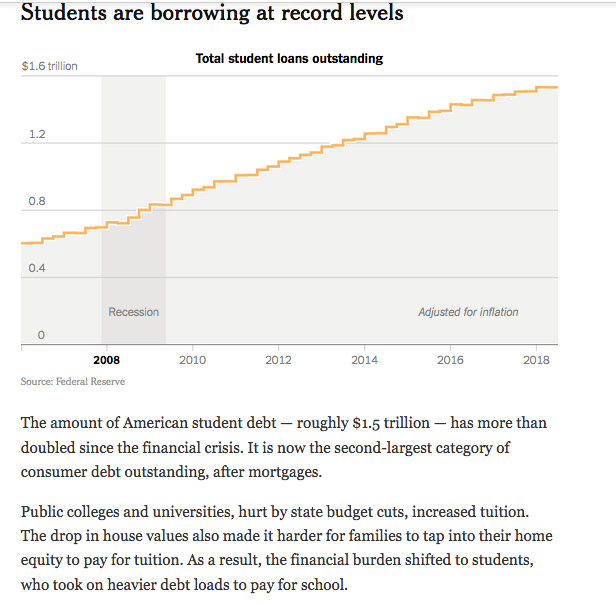

Fast-growing pockets of debt, as in the last time around, look like potential sources of problems. They’re nowhere near as big as the mortgage bubble, and no blow-ups appear imminent.

“But what we saw last time around is that things can creep up on you,” said Wesley Phoa, a bond-fund manager at the Capital Group. “You can turn around and in three years’ time you can go from not much of a problem to a pretty big problem.”