. . .

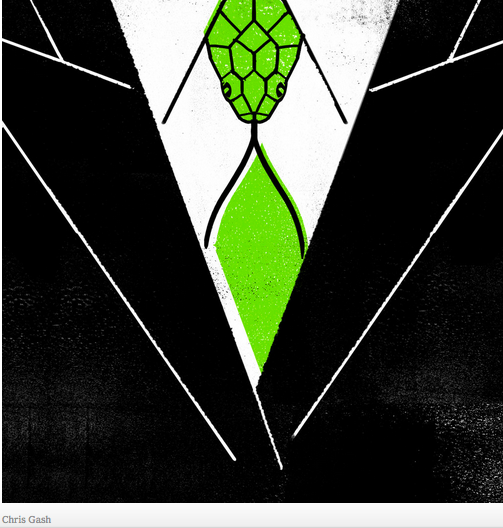

There’s a novel thought: enforcing laws on white collar crime.

Take the extensive money laundering Mr. Manafort is accused of undertaking with shell companies that hide ownership. How could he have expected to get away with it?

Perhaps he saw what happened when one of the world’s largest banks, HSBC, helped launder billions of dollars in drug proceeds for the Sinaloa cartel, for a financier for Al Qaeda and for others over nearly a decade. When they were caught, they only had to forfeit less than five weeks of profit. No bank employee was criminally charged.

Now consider the potential big fish in the special counsel’s investigation. Three years ago, about three months before Mr. Trump announced his candidacy for president, the Treasury Department’s Financial Crimes Enforcement Network fined the Trump Taj Mahal casino in Atlantic City $10 million for “willful and repeated violations of the Bank Secrecy Act” for failing to report suspicious transactions and failing to properly file currency transaction reports and keep proper records. The officials noted that the casino had “a long history of prior, repeated B.S.A. violations cited by examiners dating back to 2003.” The casino had been fined $477,700 in 1998. In other words, Mr. Trump’s casino helped launder money and no one was charged with a crime.