In November, at age 72, Mr. Stein received a diagnosis of aggressive bladder cancer that would require chemotherapy and a complex surgical procedure. The doctor who he determined was the best local specialist for his condition was not in his network, so Mr. Stein decided to switch to original Medicare for 2020 — a move that would allow him to see nearly any health care provider he chose.

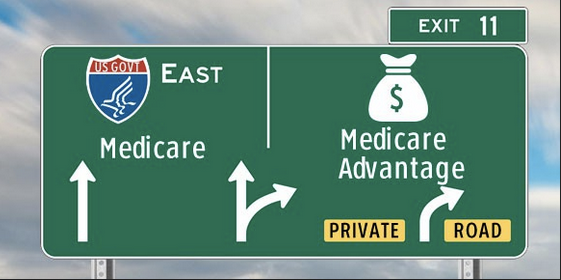

That was when he ran up against one of the least understood implications of selecting Advantage when you enroll in Medicare: The decision is effectively irrevocable.

Most enrollees in traditional Medicare buy supplemental coverage to protect them from potentially high out-of-pocket costs. In 2016, out-of-pocket spending in the program averaged $3,166, excluding premiums, according to the Kaiser Family Foundation.

Supplemental coverage sometimes comes from a former employer, a union or Medicaid, although many people buy a commercial Medigap plan. But the best, and sometimes only, time to buy a Medigap policy is when you first join Medicare.

Medicare Advantage vs. Medigap: How to Choose