Since the global financial crisis a decade ago, a few simple guidelines have helped investors make sense of the markets.

Global growth and inflation will be perpetually weak. Central banks will help by keeping interest rates low. And stocks will almost invariably rise.

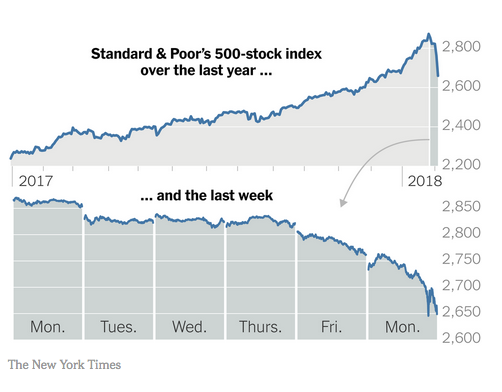

The rule book is now changing, a shift that is sending tremors through the financial markets. The Standard & Poor’s 500-stock index fell by more than 4 percent on Monday, deepening its losses from the previous week and erasing its gains for the year. The Dow Jones industrial average sank by 4.6 percent. Bond yields, the basis for key borrowing costs such as mortgage rates, have risen fast in recent weeks.

In trading in Asia on Tuesday morning, markets signaled another tough day. Major stock markets in the region plunged after the drop in the United States on Monday, suggesting the pain could continue. In Japan, stocks were down more than 5 percent in morning trading, while shares in Hong Kong were down more than 4 percent.

Those sharp moves come as investors digest the growth prospects for the world — and rebalance their views on the relative merits of stashing their cash in risky assets like stocks, safer spots such as government bonds and the myriad investment opportunities offered by a global economy moving in sync.

The world’s largest economies are all expanding, as the most important central bank, the United States Federal Reserve, is draining billions of dollars from the financial system and raising interest rates. And investors are concerned that tenuous signs of inflation could mean central banks around the world will start to remove their support even faster.