A public university president in Oregon gives new meaning to the idea of a pensioner.

Joseph Robertson, an eye surgeon who retired as head of the Oregon Health & Science University last fall, receives the state’s largest government pension.

It is $76,111.

Per month.

That is considerably more than the average Oregon family earns in a year.

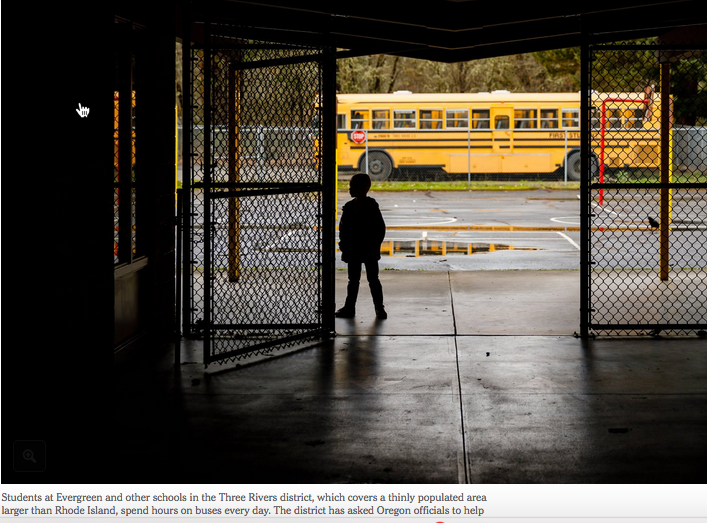

Oregon — like many other states and cities, including New Jersey, Kentucky and Connecticut — is caught in a fiscal squeeze of its own making. Its economy is growing, but the cost of its state-run pension system is growing faster. More government workers are retiring, including more than 2,000, like Dr. Robertson, who get pensions exceeding $100,000 a year.

The state is not the most profligate pension payer in America, but its spiraling costs are notable in part because Oregon enjoys a reputation for fiscal discipline. Its experience shows how faulty financial decisions by states can eventually swamp local communities.

Oregon’s costs are inflated by the way in which it calculates pension benefits for public employees. Some of the pensions include income that employees earned on the side. Other retirees benefit from long-ago stock market rallies that inflated the current value of their payouts.

For example, the pension for Mike Bellotti, the University of Oregon’s head football coach from 1995 to 2008, includes not just his salary but also money from licensing deals and endorsements that the Ducks’ athletic program generated. Mr. Bellotti’s pension is more than $46,000 a month.