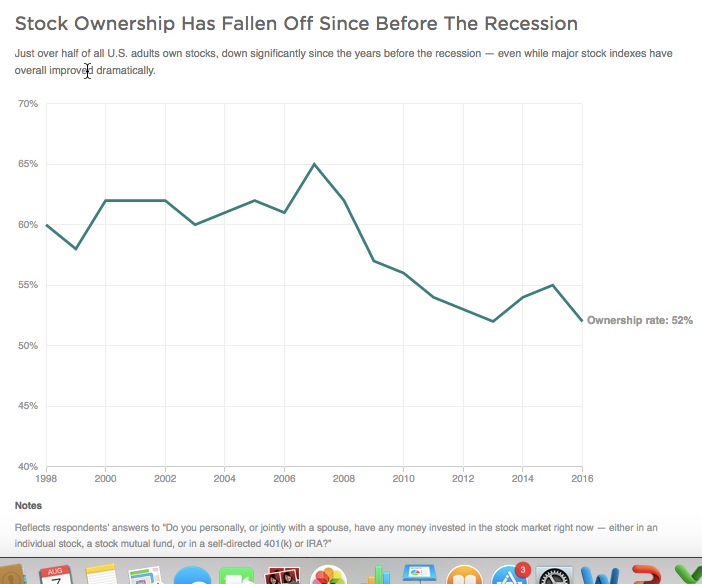

That means the stock market rally can only directly benefit around half of all Americans — and substantially fewer than it would have a decade ago, when nearly two-thirds of families owned stock.

And that decline was bigger among lower-income Americans, data from the Federal Reserve show. Of the 10 percent of families with the highest income, 92 percent owned stock as of 2013, just above where it had been in 2007. But ownership slipped for people in the bottom half of the income distribution, and to a lesser degree for people who were above the median but below the top 10 percent.

Those richest Americans own far greater amounts of stock. As of 2013, the top 10 percent of Americans owned an average of $969,000 in stocks. The next 40 percent owned $132,000 on average. For the bottom half of families, it was just under $54,000.

Combine the uneven ownership rates and ownership amounts, and the total inequality in the stock market is astounding. As of 2013, the top 1 percent of households by wealth owned nearly 38 percent of all stock shares, according to research by New York University economist Edward Wolff.

Indeed, nearly all of the stock ownership in the U.S. is concentrated among the richest. According to Wolff’s data, the top 20 percent of Americans owned 92 percent of the stocks in 2013.

Put another way: Eighty percent of Americans together owned just 8 percent of all stocks.

. . .

Indeed, former Federal Reserve Chairman Ben Bernanke listed the wealth effect as one argument for his quantitative easing programs. The Fed’s accommodative monetary policy after the recession helped goose stock prices, in part by lowering yields on safer assets like Treasury bonds. That sent investors to the stock market to invest. And as Bernanke wrote in 2010, higher stock prices would boost spending, which would “lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”

That expansion isn’t necessarily even, though. Former Dallas Fed President Richard Fisher explained to CNBC in 2016 that the Fed’s quantitative easing program boosted the prices of stocks and other assets, but that the economic benefits were limited.

“We were going to have a wealth effect. That was achieved. We made wealthy people wealthier,” Fisher said. “But the point is it didn’t trickle down.”