The recent exposé in this newspaper about the Trump family finances shines a light on the ways in which the wealthiest Americans can avoid estate and gift taxes on the transfer of assets to their children. While many of the Trump family schemes described in the report were clearly outside of the law, a disturbing number exemplify commonly used techniques.

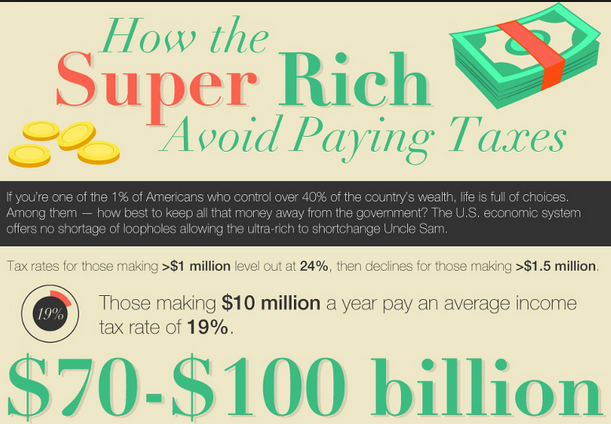

This would not be as troubling if the richest Americans paid more income taxes. But most of the wealth they acquire is not taxed as income. This situation — generous exclusions from income taxes combined with easy evasion of estate and gift taxes — has given the wealthiest a free pass on the costs of running the country.

To see how the ultrarich acquire their wealth, look at the Forbes 400, an annual listing of the wealthiest Americans. This year an individual needed to have more than $2 billion to be included, and together the Fortune 400 group controls over $3 trillion. This enormous wealth was generally acquired in one of two ways: through inheritance or by building or investing in a successful business.