Economic inequality is on the rise in Illinois, and the state government is part of the problem. Illinois taxes low-income families at much higher rates than high-income families, asking the most of those who have the least.

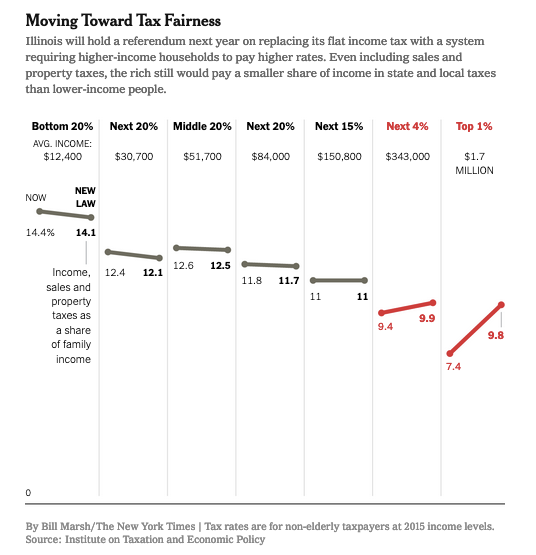

Low-income households in Illinois pay about 14 cents in state and local taxes from every dollar of income, while the state’s most affluent households pay about 7 cents per dollar.

That gap between the poor and the wealthy in Illinois is one of the largest in any state, but the poor pay taxes at higher rates in 45 of the 50 states, according to a 2018 study by the Institute on Taxation and Economic Policy.

It’s a bipartisan phenomenon. The institute’s list of the 10 states with the most regressive tax systems — the states doing the most to increase inequality through taxation — also includes conservative Tennessee and Texas, purple Nevada and Florida, and liberal Washington.