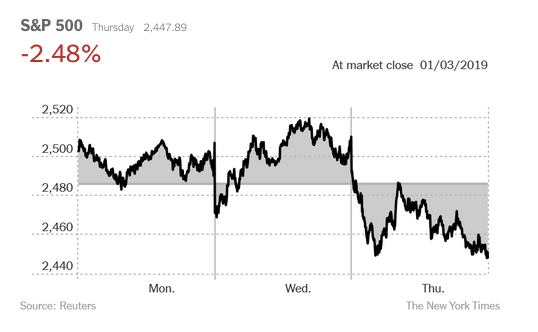

Maybe the markets were not overreacting.

With the United States economy posting solid numbers last year, the alarming signals coming out of stock and bond markets seemed out of whack with the real world. President Trump’s bellicose trade actions were a concern, but hiring was strong and corporate earnings were surging.

But this week, companies have issued warnings about the health of their businesses that suggest investors were right to be worried about growth. On Wednesday, Apple reduced its revenue expectations for the first time in 16 years, citing weak iPhone sales in China. On Thursday, Delta Air Lines said its fare revenue, while growing, would fall short of the company’s earlier forecast. And the American manufacturing sector slowed sharply last month, according to a closely watched index released Thursday.

In the coming weeks, scores of companies will report their fourth-quarter results. A senior White House economics official acknowledged that there could be a torrent of bad news from corporate America.

“It’s not going to be just Apple,” Kevin Hassett, the chairman of the White House Council of Economic Advisers, told CNN on Thursday. “There are a heck of a lot of U.S. companies that have a lot of sales in China that are basically going to be watching their earnings be downgraded next year until we get a deal with China.”