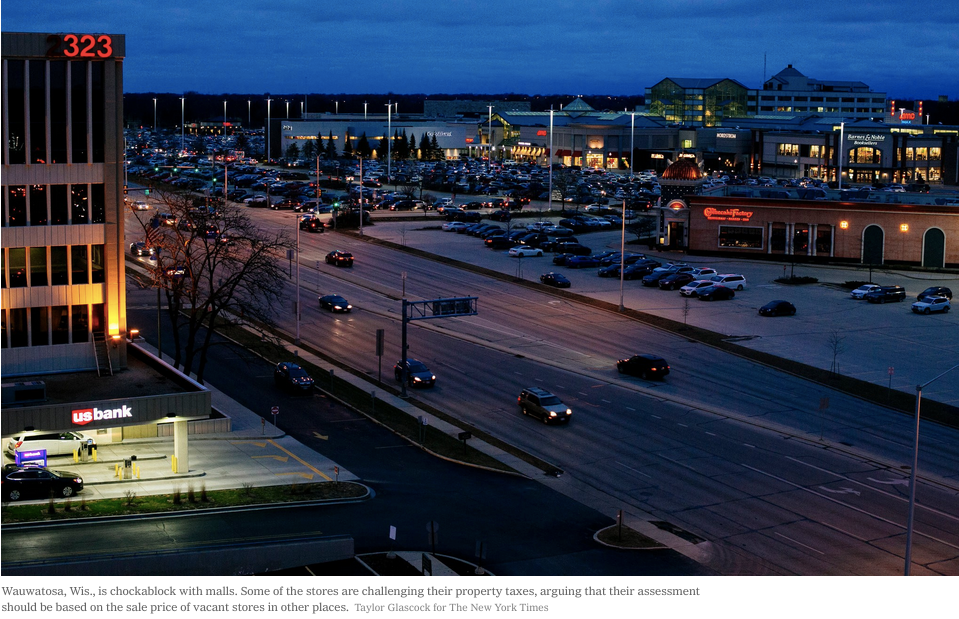

WAUWATOSA, Wis. — With astonishing range and rapidity, big-box retailers and corporate giants are using an aggressive legal tactic to shrink their property tax bills, a strategy that is costing local governments and school districts around the country hundreds of millions of dollars in lost revenue.

These businesses — many of them brick-and-mortar stores like Walmart, Home Depot, Target, Kohl’s, Menards and Walgreens that have faced fierce online competition — maintain that no matter how valuable a thriving store is to its current owner, these warehouse-type structures are not worth much to anyone else.

So the best way to appraise their property, they contend in their tax appeals, is to look at the sale prices on the open market of vacant or formerly vacant shells in other places. As shuttered stores spread across the landscape, their argument has resonated.

To municipalities, these appeals amount to a far-fetched tax dodge that allows corporations to wriggle out of paying their fair share.